This story was supported by the Pulitzer Center.

In late September, Toby Rice, president and CEO of EQT Corp., addressed fracking executives on the shores of Lake Erie. Rice, fresh from Climate Week in NYC, shared EQT’s vision for expanding fossil fuel operations in the Appalachian Basin, with a focus on increasing American gas exports.

“It’s never been more important to produce energy in this country,” said Rice, emphasizing challenges like difficult pipeline development and extensive permitting processes. He stressed the need for leaders who understand and support the energy industry.

Dave McCormick, then GOP nominee for U.S. Senate, followed Rice, advocating for America to become the global leader in energy production. He supported dismantling Biden-era drilling restrictions, enhancing fossil fuel infrastructure, and facilitating energy exports.

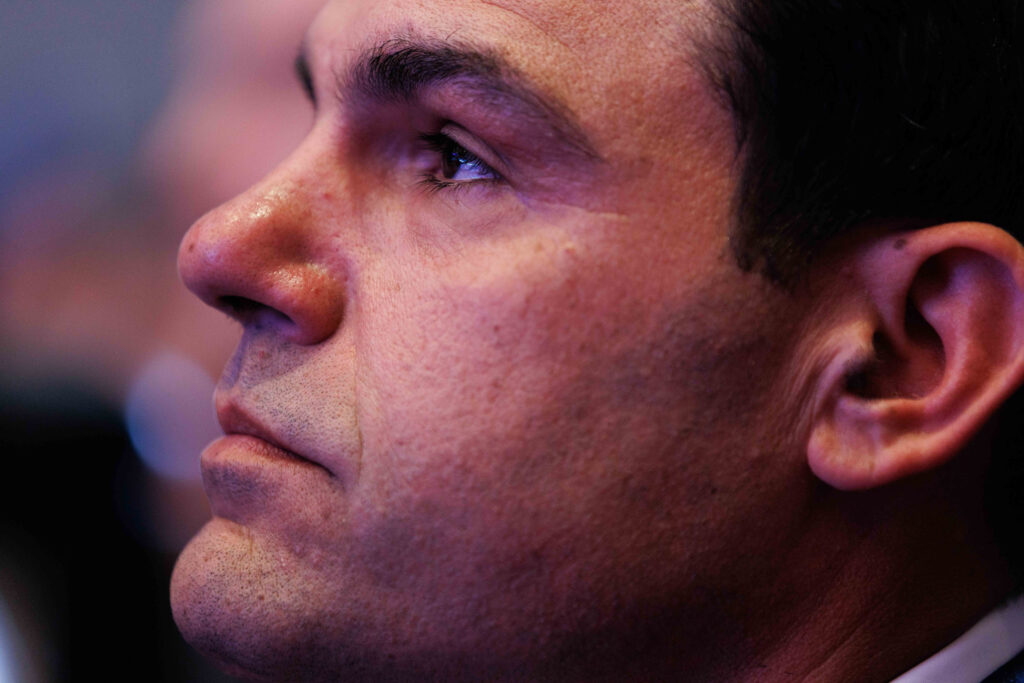

Since becoming EQT’s CEO in 2019, Rice has been a leading advocate for the Marcellus Shale gas industry, wielding considerable influence over U.S. energy policy. His “Shalennial” vision aligns with a potential shift towards fossil fuels under a Trump administration.

‘He wills things to happen’

Twenty years ago, Rice, a former All-American baseball player, was known for his bold character at Rollins College in Florida. Post-graduation, he worked on a Texas oil rig. In 2007, Rice, with family support, founded Rice Energy, a key player in the Marcellus Shale market.

Rice’s rise in the industry is considered remarkable. His leadership style is described as charismatic and hands-on, with a strong focus on technology and efficiency.

Rice Energy was sold to EQT for $6.7 billion in 2017, creating a major Appalachian gas firm. Rice later led a successful proxy battle to take control of EQT.

A fracking and lobbying force

Rice operates EQT from Carnegie, PA, where his office reflects a blend of modern and traditional energy industry ethos. As CEO, he has emphasized efficiency and innovation, acquiring Tug Hill for $5.2 billion to boost drilling capacity.

Rice champions U.S. liquified natural gas (LNG) exports, although some climate experts disagree with his claims of environmental benefits. He has been publicly active, rebutting allegations of price gouging with a focus on LNG’s potential.

EQT has entered significant LNG supply agreements, including contracts with facilities in Louisiana and Texas, bolstering its position in the global energy market. Despite federal challenges to LNG export permits, EQT continues lobbying efforts to promote LNG, supported by donations to political campaigns.

More pipelines, more exports

Rice views LNG as a global strategic asset, necessary for geopolitical stability and economic growth. However, experts like Clark Williams-Derry argue this approach has strained the industry financially.

Pipeline capacity remains a challenge. Rice has directed significant political contributions towards facilitating pipeline construction. The Mountain Valley Pipeline finally came online, aided by legislative efforts led by Sen. Joe Manchin.

Rice’s acquisitions, including Equitrans, position EQT as a vertically integrated firm, ready to expand globally. Under a Trump administration, a pro-LNG stance is anticipated, potentially increasing U.S. gas exports.

Increased LNG exports could raise domestic energy prices, impacting U.S. consumers. Organizations like the Industrial Energy Consumers of America have voiced concerns about unchecked export capacity leading to higher costs.

Community groups have expressed environmental and public health concerns related to LNG projects. Critics argue that exports serve international markets at the expense of domestic consumers.

Rice and EQT continue to advocate for LNG, investing in campaigns to promote its benefits despite concerns over its environmental impact and implications for U.S. energy prices.

Original Story at insideclimatenews.org