Nauru’s Ambitious Plan: Selling Citizenship to Combat Climate Threats

In a bold move to combat the looming threats of climate change, the island nation of Nauru is offering citizenship for sale. This initiative aims to fund the relocation of around 10,000 residents from low-lying areas vulnerable to rising sea levels and floods.

President David Adeang has announced an ambitious goal to raise $65 million. This funding will be directed towards transforming Nauru’s interior, a region devastated by phosphate mining, into a viable new settlement complete with homes, farms, and workplaces. Ultimately, the plan envisages relocating approximately 90% of the nation’s population.

Prospective citizens, willing to pay at least $140,500, can obtain Nauru’s passport, which offers visa-free travel to countries like the UK, Singapore, and Hong Kong. Most of these new citizens might never visit Nauru, located about 4,000 kilometers northeast of Sydney. In a statement, Adeang said, “While the world debates climate action, we must take proactive steps to secure our nation’s future. We will not wait for the waves to wash away our homes and infrastructure.”

Following the footsteps of nations like Dominica, Nauru plans to leverage funds from citizenship sales to counteract climate change impacts. This strategy highlights the financial challenges small nations face in building resilience against environmental threats. Despite increased financial aid from wealthier nations, the United Nations Environment Programme reported a significant shortfall, estimating a $359 billion annual gap in required adaptation financing.

The urgency of Nauru’s situation was underscored during last year’s COP29 summit in Azerbaijan, where negotiations over climate finance stalled. Wealthy nations pledged $300 billion annually for climate action, far short of the over $1 trillion sought by a bloc of small island states, including Nauru.

Adeang expressed frustration at the UN General Assembly, noting the ongoing struggle for climate finance and the nation’s frequent relegation “to the back of the queue.” Between 2008 and 2022, Nauru secured $64 million in development financing focused on climate change, according to the Lowy Institute.

NASA’s Sea Level Change Team has warned of significant increases in flooding for Nauru in the coming decades. From 1975 to 1984, there were 8 flooding days, which increased to 146 between 2012 and 2021. The escalating threat of major floods jeopardizes Nauru’s coastal infrastructure, including the nation’s sole airport, as highlighted by Alexei Trundle from the Melbourne Centre for Cities.

Paul Dargusch from Monash Business School’s Pacific Action for Climate Transitions shared an account of a severe flood last year, emphasizing the vulnerability of Nauru’s coastal population. “The whole population lives around the fringe of the country, and three or four parts of that — the most populated parts around that fringe — are very exposed to storm surges,” he noted.

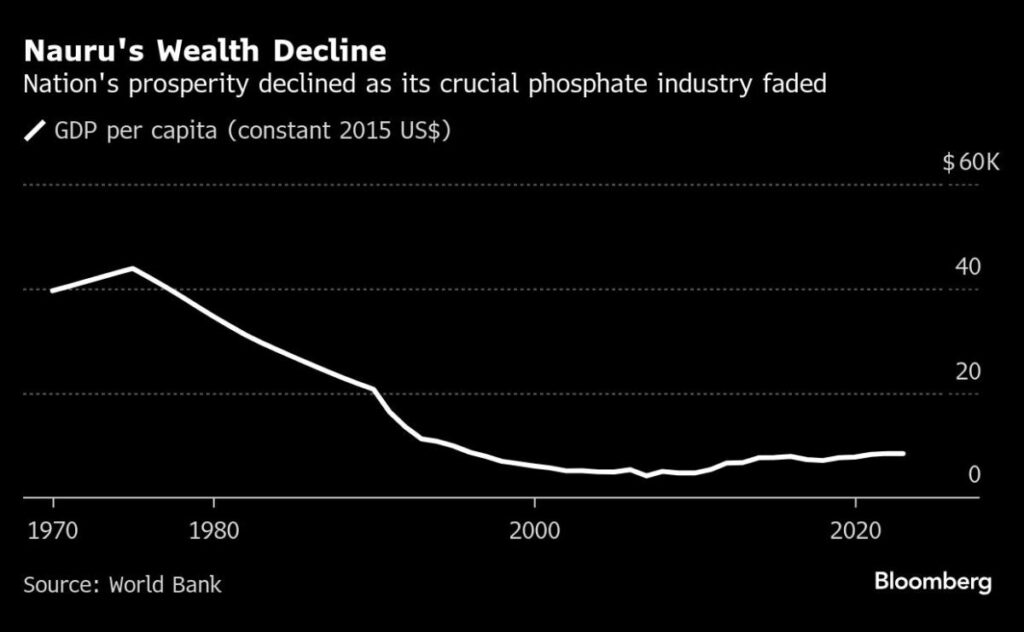

The citizenship program is a key component of Nauru’s Higher Ground Initiative, outlined in 2019. An initial A$102 million phase is underway to reclaim about 10 hectares of mined land, known as Topside. This area was exploited for phosphate, a vital fertilizer component, for nearly a century until Nauru’s independence in 1968.

In the past, Nauru faced scrutiny over its investor passport program, which was suspended in 2003 due to misuse by international criminals. President Adeang acknowledged these past issues, stating, “We are acutely aware of the challenges faced by previous citizenship programs worldwide.” Edward Clark has been appointed CEO of the Nauru Program Office to ensure compliance with stringent measures.

Currently, Nauru is processing its first applications, with inquiries from the UAE, the US, Pakistan, and the UK, as reported by Henley & Partners. The government anticipates generating around A$9 million from citizenship sales by June 30, aiming to increase this to A$68 million annually. This is part of the broader effort to support the national budget, which forecasts A$311 million in revenue.

Kristin Surak, of the London School of Economics, commented on the enduring demand for such programs, emphasizing the need for transparency in the vetting process and financial flows.

Original Story at finance.yahoo.com