GM Reduces U.S. Battery Plant Operations Amid Uncertain EV Market

In a strategic shift, General Motors (GM) has decided to sell its ownership in a Michigan battery plant to LG Energy Solution. This move will decrease GM’s battery plant operations in the United States to three facilities as automakers realign their electric vehicle (EV) strategies due to underwhelming sales and potential policy changes with President-elect Donald Trump assuming office.

The unexpected slowdown in EV sales has prompted many manufacturers, including GM, to reassess their production plans. High production costs, largely attributed to the expensive batteries powering these vehicles, have overshadowed the benefits of subsidies within the Inflation Reduction Act. This has led to a cautious approach by automakers eager to maintain profit margins.

“We’re focused on optimizing our battery technology by developing the right battery chemistries and form factors to improve E.V. performance, enhance safety and reduce costs,” stated Kurt Kelty, GM’s vice president of battery cell and pack, emphasizing the company’s commitment to advancing battery technology.

Alongside GM, companies like Ford and Volkswagen have also adjusted their EV rollout plans, reflecting a broader industry trend. The initial anticipation that the EV market would experience rapid growth post-COVID was met with consumer skepticism, as noted by Z. Justin Ren from Boston University’s Questrom School of Business. “GM and other auto companies a few years ago, stepping out of COVID, they thought the EV market would just take off,” Ren explained. However, the anticipated surge in demand did not materialize, leading to recalibrations in strategy.

Despite the challenges, the electric vehicle market has seen growth, though it remains slow. In October, pure electric vehicles represented 8% of total U.S. vehicle sales according to the International Energy Agency. GM has emerged as a leader among American manufacturers, second only to Tesla in terms of third-quarter sales, as noted by Cox Automotive. There is potential for further growth as consumers rush to take advantage of existing tax credits.

However, the landscape could shift with Trump’s administration. Trump’s stance against EV incentives, including the potential removal of the $7,500 tax credit, raises concerns for both manufacturers and consumers. Ren suggests that while some market segments might remain unaffected, others could see a significant decline in purchasing intent. “If you take a $7,500 incentive away, people’s purchasing intent is decreased, no doubt about it,” Ren stated, indicating the potential impact on different manufacturers.

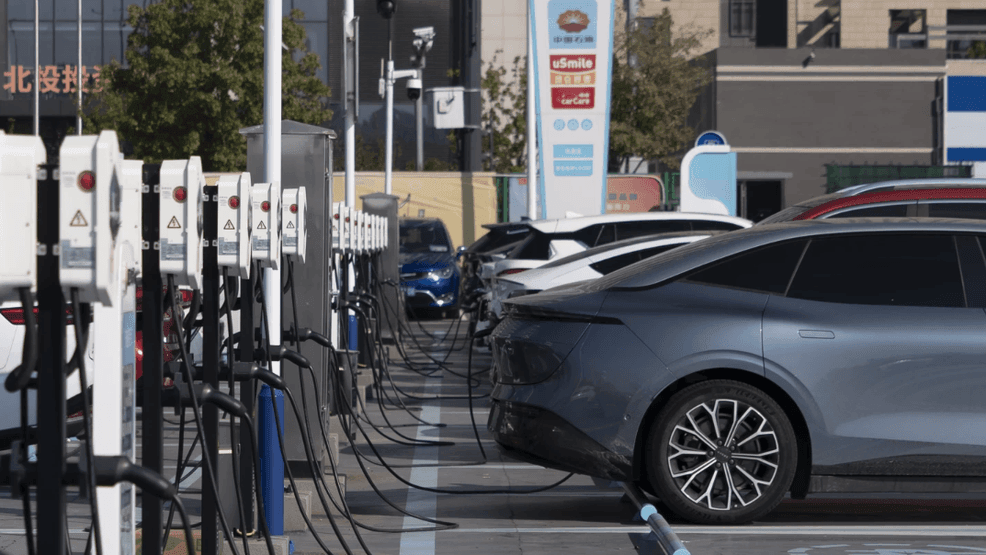

Globally, electric vehicles, including plug-in hybrids, are projected to account for about 20% of car sales, with China leading the charge. This dominance presents a challenge for U.S. and European automakers competing in the EV market. Chinese automakers benefit from substantial subsidies and incentives, allowing them to offer competitive pricing.

China’s control over vital elements of the EV supply chain, such as lithium mining, has prompted President Joe Biden to prioritize reducing dependency on Chinese resources. In response, significant investments have been directed towards boosting U.S. manufacturing capacity and mining efforts for essential minerals.

Nevertheless, the ambitious timelines set by American automakers to transition from combustion engines to electric vehicles face challenges. Consumer reluctance due to pricing, limited charging infrastructure, and range anxiety persist as barriers. Though EV prices have decreased, they remain higher than traditional vehicles, with the average EV costing $56,902 in October compared to $48,623 for a conventional vehicle. The potential removal of tax credits could further widen this gap.

Charging infrastructure remains a crucial concern. The current lack of fast-charging stations exacerbates range anxiety among potential buyers. While substantial investments are underway to improve this infrastructure, the transformation into a robust charging network requires time.

Original Story at wgxa.tv