The US Gulf Coast is likely the only place where two men with minimal experience in the energy sector could revolutionize the industry and become billionaires.

Over a decade ago, ex-banker Mike Sabel and lawyer Bob Pender were driving across Texas, seeking funds to build a multibillion-dollar plant to liquefy and export US shale gas. Despite the dominance of supermajors and petrostates, they realized their vision and founded Venture Global LNG, now on track to become one of the largest US LNG suppliers. The US has surpassed Australia and Qatar as the top LNG exporter over the past eight years.

The question is whether Venture Global can maintain its growth amid political pressures and strained relationships with customers and rivals.

“We just grind through it,” Sabel said at the company’s $21 billion LNG plant in Louisiana, its second such facility. “We look up and often we’re very surprised by the progress.”

Venture Global’s strategy is based on the belief that countries transitioning from oil and coal will turn to LNG as a cleaner-burning alternative. Shell Plc forecasts LNG demand to grow by more than 50% through 2040.

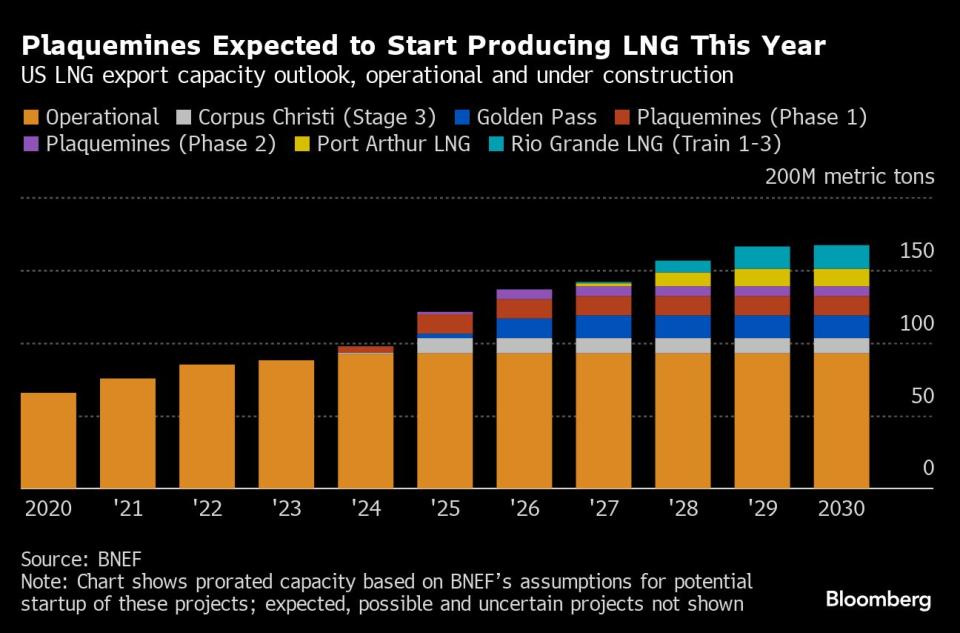

Sabel and Pender revamped LNG facility designs, opting for modular setups with smaller units. Their first plant, Calcasieu Pass, went from final investment decision to fuel export in just 29 months, despite being $1 billion over budget. The second site, Plaquemines, is ahead of schedule and expected to produce LNG soon.

From these two plants, Venture Global is set to produce 30 million tons of LNG annually, about a third of the current US market. If their additional projects advance, they could challenge Cheniere Energy as the largest US LNG exporter.

“VG took a big risk by adopting this novel design,” said LNG consultant Amit Kshatriya. “It seems to have paid off.”

However, the company faces pushback. Environmentalist Bill McKibben urged the Biden administration to scrutinize LNG projects, calling Venture Global’s next project a “poster child for late-stage petrocapitalism.”

In January, the administration suspended new LNG export licenses. Despite the Federal Energy Regulatory Commission’s approval for CP2, the project still needs an export license from the Energy Department, likely delayed until after the 2024 election.

During this uncertainty, importers are exploring alternative suppliers, casting doubt on the US as a reliable partner.

Venture Global’s long-term customers, including BP Plc and Shell, have not received contracted shipments, leading to arbitration cases and demands for regulatory interventions.

“Deciding not to honor the very contracts that put them in business is not disruption. It’s deceit,” said Curtis Smith, Shell’s North America spokesperson.

Sabel remains undaunted despite facing multiple arbitration cases with major oil companies. Venture Global has not signed a new long-term contract in over a year, and global buyers are incorporating new terms to avoid similar disputes.

In 2023, Venture Global earned $7.8 billion from spot sales. Analysts estimate the company could be worth up to $100 billion, though Sabel and Pender declined to comment on its valuation.

Sabel has been active globally, meeting with leaders like German Chancellor Olaf Scholz and Japan’s Prime Minister Fumio Kishida. Despite challenges, he remains optimistic about their entrepreneurial journey.

—With assistance from Vernal Galpotthawela, Madlin Mekelburg, and Andrew Heathcote.

Original Story at finance.yahoo.com