France’s Auto Market Sees Shift Towards Electric Vehicles in May

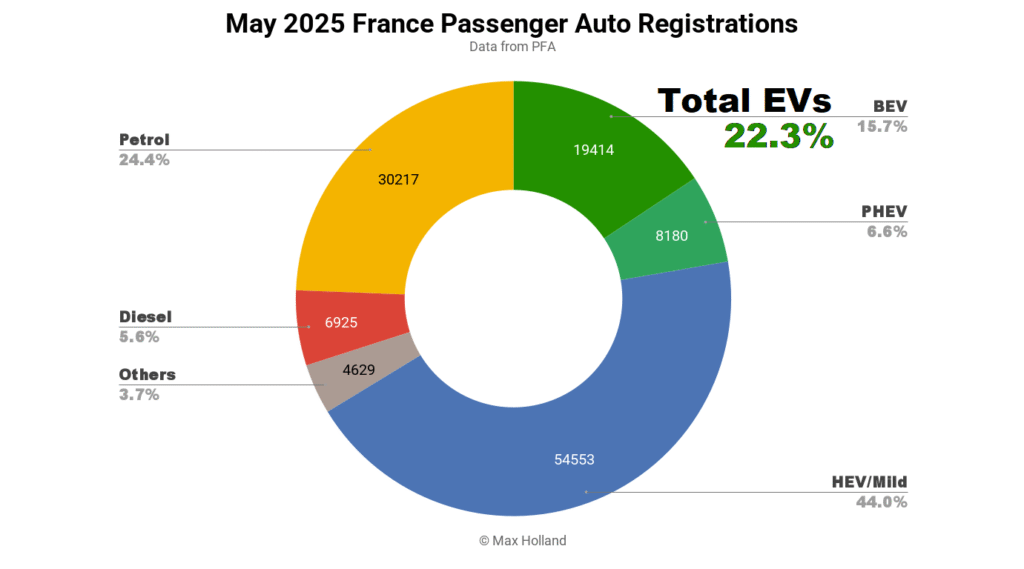

In May, the French automotive market experienced a notable shift as electric vehicles (EVs) accounted for a significant portion of sales. Despite a slight decline from the previous year, plugin EVs made up 22.3% of the market share, with battery-electric vehicles (BEVs) reaching 15.7% and plugin hybrids (PHEVs) at 6.6%. The total vehicle sales for the month amounted to 123,919 units, marking a 12% decrease from the previous year.

The Citroën e-C3 secured its position as the top-selling BEV for the month, as Tesla’s Model Y faced delays in volume deliveries. This delay was attributed to pending approvals for France’s 2025 Eco-bonus eligibility. However, expectations remain high for Tesla and other models like the Volvo EX30 and Hyundai Inster once approvals are granted.

BYD introduced the Dolphin Surf model in May, registering 414 units for showrooms and test drives. The Dolphin Surf, priced under €20,000, aims to capture the affordable BEV segment, which has gained traction in France with models like the Renault 5 and Citroën e-C3.

In the broader market landscape, hybrid electric vehicles (HEVs) continue to replace combustion-only vehicles. Petrol-only sales saw a 30% drop, now holding a 24.4% market share, while diesel-only sales plummeted by 40%, representing just 5.6% of the market.

Top Contenders in the BEV Market

May’s best-selling BEV models saw the Citroën e-C3 outperform the Renault 5, each selling around 1,500 units. The Renault Scenic followed closely, with 1,036 units sold. The Citroën e-C3 Aircross made significant gains, advancing to fourth place with 920 units, up from 16th in April. The Skoda Elroq also improved, moving to sixth place with 683 units.

As BYD’s Dolphin Surf prepares for its official launch, the entry model is expected to appeal to budget-conscious consumers. Another new entrant, the Renault 4, debuted with a starting price just below €30,000, offering a larger alternative to the Renault 5.

In the trailing-quarter sales chart, the Renault 5 remains dominant, though the Citroën e-C3 leads for May. The upcoming months may see the Citroën e-C3 Aircross and Renault 4 join the top ranks, with the Dolphin Surf also expected to make strides by year-end.

Market Outlook

The French auto market’s slowdown in May aligns with the country’s economic trends, with Q1 2025 showing a modest 0.6% growth. Inflation rates stood at 0.7% in May, while the European Central Bank’s interest rates held at 2.4%. Manufacturing PMI showed a slight improvement, rising to 49.8 points.

Despite these economic challenges, the introduction of more affordable BEV models continues to drive momentum in the electric vehicle market in France and across Europe. As the market evolves, industry observers are keen to see which models will lead the transition in the coming months.

For more details on the automotive market and economic indicators, visit Trading Economics.

Original Story at cleantechnica.com